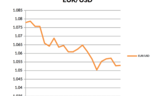

Early on this month the number of jobs added to US non-farm payrolls in January soared to 227,000, Economists had expected a rise of 175,000 jobs during the last month, but the measure instead jumped to its highest point since July. However disappointing wage growth reduced expectations of another interest rate rise from the Federal Reserve, with a March move at this stage was given just a 9 percent chance from about 18 percent Thursday and as a result the USD was sold off. The tone continued with St. Louis Federal Reserve Bank President James Bullard stating yesterday that U.S. interest rates are likely to remain low throughout 2017, with no clear direction as yet on whether President Trump’s administration's policies will spark higher inflation or growth.

U.S. President Donald Trump said that he would be releasing his "phenomenal" tax plan in the next few weeks. Investors have been eagerly awaiting details on Trump's campaign trail which promised to inject the U.S. economy with large-scale fiscal stimulus through additional spending and tax cuts.

By mid- way through February the Feds tone has changes with Fed Chair Janet Yellen citing that "Waiting too long to remove accommodation would be unwise," Yellen said in prepared remarks before the U.S. Senate Banking Committee, citing the central bank's expectations the job market will tighten further and that inflation would rise to 2 percent. In the Final week of Feb minutes of Federal Open Market Committee’s latest meeting revealed that officials expressed confidence that they can raise interest rates gradually, while a hike “fairly soon” might be appropriate to avoid the risk of an overheated economy.

Fed officials are concerned about Trump’s potential fiscal stimulus plans, and the effects of a rising Dollar.

With the US Fed announcement on interest rates only a few days away Investors increasingly believe that a U.S. interest rate hike will come sooner rather than later, with a 66.4% probability of a March hike now priced in.

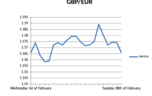

The Pound strengthened early on in the month after a strong performance by the manufacturing sector, which has rebounded since the Brexit vote, to record its sixth consecutive month of expanding output.

Analysts indicate that the rising cost of imports is expected to push up the price of UK-made goods over the coming year and send inflation from 1.6% to nearer 4%.

The Bank Of England monetary policy committee voted unanimously (9-0) to hold interest rates at record lows of 0.25% and to continue with quantitative easing. Governor Mark Carney cautioned about potential challenges ahead as the UK starts the formal process of leaving the EU, and emphasised that interest rates could still move in either direction as the Bank will respond accordingly.

The Pound strengthened after Bank of England policymaker Kristin Forbes suggested she is getting closer to voting for a rate rise to stop inflation rising too high.

The UK’s lower house of Parliament gave the government its approval to begin the formal process of leaving the European Union, in a vote that brings Prime Minister Theresa May a step closer to triggering Brexit.

The European Commission boosted the UK's growth forecasts yesterday indicating the impact of Brexit on the country's economy might not be as bad as originally feared.

Mark Carney said the UK inflation rate will probably hit the Bank’s target, of 2%, this month due to the 18% depreciation in the value of the pound since June. With inflation expected to peak at 2.8% in 2018.

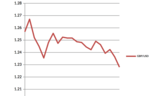

Early in February European Central Bank President Mario Draghi said that abolishing the Euro would not benefit any country in the currency bloc, and governments mostly have themselves to blame for their economic problems. Euroscepticism has gained ground in the Eurozone as the political landscape has become more populist, and Draghi said that the root cause of Europe's economic problems was political.

ECB governor Mario Draghi criticized the policies of US President Donald Trump, rejecting deregulation and protectionism as well as claims Germany is manipulating the euro. Draghi also reaffirmed the ECB’s commitment to its expansive monetary policy, saying the central bank was ready to increase the pace of its quantitative easing programme of bond buying if necessary.

Greece are hoping for positive news on a bailout review which would allow it to tap cheap ECB funding, as a top European official ruled out imminently extending debt relief sought by the IMF for the crisis-hit nation.

The Euro has been volatile recently off the back of polls and rumours surrounding the far-right French presidential candidate Marine Le Pen. Veteran French centrist Francois Bayrou announced that he was offering an alliance with independent candidate Emmanuel Macron, in a move that could give the former investment banker a much-needed boost to reach the runoff in May's presidential election. Macron has been a pro-EU voice in the French election campaign, pitted against the anti-EU Le Pen and the right-wing Fillon, who also does not appear to be an EU fan.

French stocks were boosted after controversial right-wing French presidential candidate Francois Fillon confirmed that he intends to remain in the race. The decision could strengthen the position of centrist Emmanuel Macron - who, polls show, would beat far-right anti-EU leader Marine Le Pen.