In September The Bank of England revealed the details of its £10bn money-printing programme, in which it will buy high-quality company bonds. The central bank said it aimed to buy bonds so that its holdings were representative of the British corporate bond market as a whole. The Bank will purchase bonds on the 27th of September for an initial period of 18 months. Further signs of how the UK economy is performing since the Referendum were shown with UK inflation data for August released. CPI year on year for august increased 0.6%, slightly below the forecast of 0.7%.

The CPI data for 2016 to date has been relatively low but better than figures seen last year – this being a year of historically low inflation, with the rate being around zero for much of the year. Furthermore, PPI input m/m, this being the price of goods bought and sold by manufacturers in the UK, grew marginally at 0.2% against a more optimistic forecast of 0.6%. Another encouraging sign was the UK Labour market showing buoyancy following the Brexit vote in June, with the unemployment rate being printed the same as previous at 4.9%. The number of people in work rose by 174,000 as per ONS statistics.

September also saw the Bank of England hold interest rates at 0.25% but signal another cut is still on the cards later this year despite a Brexit bounce in the economy. The sharp fall in sterling since Britain voted to leave the European Union encouraged tourists to go on a spending spree, providing a little relief for the economy as it faces an overall sharp slowdown. Foreign visitors have helped boost high street sales since the referendum on June 23. The Brexit effect might also be helping Britain to lure visitors away from other European countries.

The BoE's regional agents found signs of resilience in consumer spending and the housing market, but they also detected a growing reluctance among businesses to hire and invest. The pound came under further selling pressure last week after foreign secretary Boris Johnson hinted that the UK should trigger article 50 early next year.

Jeremy Corbyn won a decisive victory in his second leadership contest in September, beating Owen Smith and thereby strengthening his grip on the party. Corbyn managed to claim 62% of the vote in a bitter leadership battle that has dragged on over several months

Data in September showed U.S. consumer prices increased more than expected in August as rising rents and healthcare costs offset a drop in gasoline prices, pointing to a steady build-up of inflation that could allow the Federal Reserve to raise interest rates this year. Consumer Price Index rose 0.2 percent last month after being unchanged in July. Retail sales fell in August for the first time in five months, hinting at a smaller rebound in the economy this quarter.

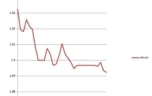

The Federal Reserve once again left interest rates on hold at the September meeting, as expected. It said that economic activity had picked up, job gains were ‘solid’, and that the case for a rate increase ‘had strengthened’. Three out of ten of the US central bank’s rate-setters called for an immediate increase, but ultimately the Fed opted to keep its policy on hold as it waits for further evidence of progress towards its objectives. Since December 2015, the US central bank has kept its target rate for overnight lending between banks in a range of 0.25% to 0.5%.

While the Fed strongly signaled it could tighten monetary policy by the end of the year, the "dot plot," which it uses to signal its outlook for the path of interest rates, shows that policy makers expect one quarter-point rate increase this year, followed by just two next year.

Manufacturing activity in September grew at the slowest pace in three months as purchasing managers blamed weak new orders and the strong dollar, according to data. Soft new orders, lower domestic demand and a renewed dip in export sales were the key reasons growth was subdued in September.

A reasonably quiet start in the Eurozone apart from the German ZEW Economic data release which came out at 0.5 points, 2.3 points less than expected. German exports, particularly to non-EU countries, as well as industrial production figures have disappointed. By contrast, the economic environment in the European Union is improving. Overall, the ZEW Indicator of Economic Sentiment suggests that the economic situation in Germany will remain favorable in the coming six months”. Greece will tell its creditors that it cannot comply with Labour reforms demanded by the International Monetary Fund as a condition of its support for the country's third bailout.

Both the IMF and the EU said an inflexible Labour force has helped to make Greece uncompetitive, contributing to its economic condition. Labour reforms are a sensitive issue for Prime Minister Alexis Tsipras, running a country with a 23.4 percent jobless rate, high levels of informal work and cash-strapped pension funds. Mario Draghi spoke at the conference of the European Systemic Risk Board where he took on critics from the banking sector who blamed the ECB’s negative interest rate policy for squeezing their margins. Draghi said the Eurozone has too many banks, blaming overcapacity rather than the European Central Bank’s monetary policy for low profits among commercial lenders.