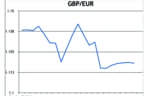

Brexit negotiations initially got off to a shaky start as it seemed that British cabinet ministers were unable to reach an agreement on the best course of actions and the government also seemed at war with itself over the divorce terms. The pound suffered losses mid last month after inflation rate slipped to 2.6 percent in June, the first drop in the annual rate since October. With economists having forecast the figure to hold at a four year peak of 2.9%, doubts were raised over whether the Bank of England would be raising interest rates at its next policy meeting.

Later in the month the ONS also revealed that that GDP grew by 0.3% in the second quarter of the year, up from 0.2% growth in Q1, with the services sector performing particularly well. However the positive data rather than buoying the pound cemented expectations that the Bank of England would be keeping interest rates on hold at their record low level.With the Bank of England "Super Thursday" looming, many investors sought rhetoric over whether interest rates could be hiked in coming months. Economists were expecting the Bank to push up its inflation forecasts slightly but to lower its projection for growth after the weak start to the year. However sterling fell sharply following the meeting as the bank announced that interest rates would remain unchanged at 0.25% and also cut the growth forecasts to 1.7% to 1.9%.The dollar struggled against various major currencies amid doubts over the future of President Trump’s economic agenda after Republican efforts to repeal and replace Obamacare derailed in the US Senate.

The failure to deliver on healthcare reform dealt a major policy blow to the Trump administration and indicated that other reforms such as overhauling the tax code and implementing fiscal stimulus could face difficulties.Recent weak US inflation data and the prospect that other major central banks such as the ECB and the Bank of England may join the Federal Reserve in normalizing monetary policy, have also fed weakness in the dollar. During July the dollar slumped to a thirteen-month low against a range of major currencies on Friday amid a fresh wave of political uncertainty after newly published reports revealed that president Trump’s private business is also set to come under scrutiny.

Special counsel Robert Mueller is currently looking into the business dealings of the president and major Republican associates and is now set to expand investigations into allegations that Russia influenced the 2016 US presidential election. The reports follow from developments earlier in the week after Republican lawmaker’s intercepted efforts to repeal and replace Obamacare, dealing a major policy blow to the Trump administration.

With continued aggravation between North Korea and the US China moved to tighten economic pressure on North Korea on Monday by implementing a new package of U.N. sanctions, but simultaneously had a warning for the Trump administration: don’t spoil our new-found unity by starting a trade war. The Commerce Ministry announced a ban on imports of iron ore, iron, lead and coal from North Korea effective Tuesday. The Chinese customs agency said it will stop processing imports of North Korean coal, iron and lead ores and fish at midnight on Sept. 5. "After that, entry of these goods will be prohibited," said an agency statement.The announcement follows an escalating exchange of angry words between U.S. President Donald Trump and Kim's government.

Trump declared the U.S. military "locked and loaded" while Pyongyang threatened to fire four missiles into waters near the U.S. territory of Guam. The latest U.N. sanctions are intended to block North Korean exports worth $1 billion — a significant share of total exports valued at $3 billion last year. At the same time, Beijing warned President Trump not to split the international coalition over North Korea by provoking a trade war between China and the United States.Eurozone inflation figures fell in June, the European Commission confirmed, easing pressure on the European Central Bank to start tightening monetary policy.

The stubborn refusal of inflationary pressure to pick up towards the ECB’s two per cent target, despite the continued fall in unemployment in the Eurozone, has made the central bank wary of raising tightening conditions either by stopping quantitative easing (QE) or raising its key interest rates. Speculation has mounted since the ECB’s last meeting in June that the central bank might be readying markets for tighter policy. Greece made a successful return to the financial markets, spurring some confidence in the embattled economy.

Selling €3bn worth of its new five-year Government bond, at an interest rate of 4.625%, lower than the 4.95% that Greece last sold five-year bonds for, in 2014.A government official says the sale was an “absolute success” also adding that “It reaffirms the positive trajectory of the Greek economy which is making steady steps to exiting crisis and bailout programmes.”

There is already talk of further sales in the months ahead.Greece’s current bailout programme expires in summer 2018. Athens is desperate to avoid a fourth rescue deal, so is hoping that yesterday’s deal could be the first step towards gaining further market access.